Your What does a w9 form look like images are ready in this website. What does a w9 form look like are a topic that is being searched for and liked by netizens today. You can Get the What does a w9 form look like files here. Download all royalty-free vectors.

If you’re searching for what does a w9 form look like images information related to the what does a w9 form look like interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

What Does A W9 Form Look Like. What does it look like. It is also called the Wage and Tax Statement and is used to report information about money earned and taxes deducted to the Social Security Administration SSA the IRS and to employees. To get started download the latest W-9 form from the IRS website. Lets go over what this means for you.

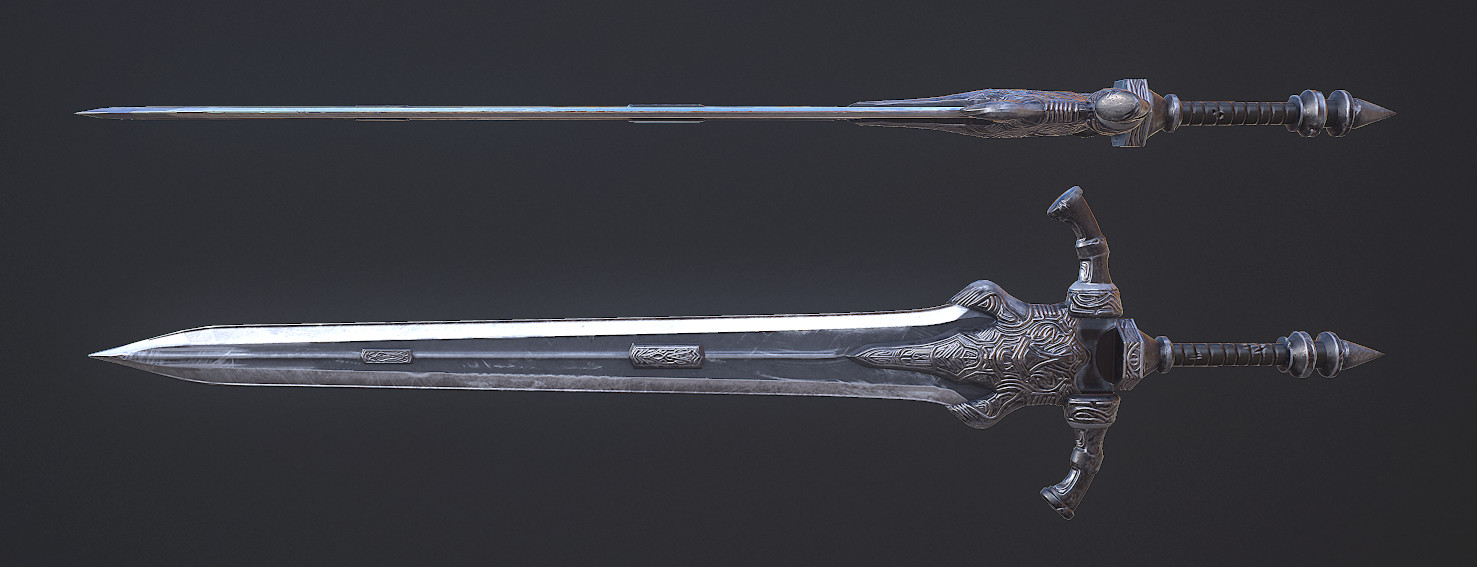

Pin By Barney Crooks On Gothic Samurai Samurai Gear Gothic From cz.pinterest.com

Pin By Barney Crooks On Gothic Samurai Samurai Gear Gothic From cz.pinterest.com

Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. It will ask for most of the same information youll need for the tax interview anyways. The form also provides other personally identifying information like your name and address. Print Or File Online - Free. What does it look like. Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file.

Keep in mind that youll need to.

Keep in mind that youll need to. March 7 2019 The IRS Form W-9 tax form is vital for small business owners. Complete Edit or Print Tax Forms Instantly. All kinds of people can get a 1099 form for different reasons. If you paid an independent contractor more than 600 in. What is a W-9 tax form.

Source: cz.pinterest.com

Source: cz.pinterest.com

The information part at the top. Boxes 2 through 6 show you what income was withheld for taxes based on federal income tax state income tax Medicare social security tax and so on. This form which is sometimes miswritten as a Form W9 first asks for information such as the person or entitys name and address. What does a W-9 look like. W-9 Form Defined.

Source: cz.pinterest.com

Source: cz.pinterest.com

This form is used to report mortgage interest income non-employee income and debt cancellation to the IRS. The W-9 form requires the contractor to list his or her name address and taxpayer ID number. This form is used to report mortgage interest income non-employee income and debt cancellation to the IRS. It was developed by Internal Revenue Service with the purpose to control how self-employed individuals and businesses that provide services pay taxes they owe. Doing so correctly can prevent tax issues from.

Source: cz.pinterest.com

Source: cz.pinterest.com

The information part at the top. A 1099 is an information filing form used to report non-salary income to the IRS for federal tax purposes. There is a section where a box must be checked to indicate what type of person or entity is completing the form such as a trust or estate an individual a corporation a partnership or an exempt payee. It takes a couple of extra steps for you since Twitch is an American company. A 1099 form is a record of income.

Source: cz.pinterest.com

Source: cz.pinterest.com

You should also update the form when you experience major changes that affect your taxes like when you marry or have a child. The form officially called Form W-9 Request for Taxpayer Identification Number and Certification is typically used when a person or entity is required to report certain types of income. Complete Edit or Print Tax Forms Instantly. W-9 is an official document that has 6 pages with fields to complete and instructions. It also comes with five pages of instructions.

Source: cz.pinterest.com

Source: cz.pinterest.com

Check the date in the top left corner of the form as it is updated occasionally by the IRS. Download Print Instantly. For example freelancers and independent contractors often get a 1099-MISC or 1099-NEC from their. Print your full legal name as it appears on your income tax return here. It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification.

Source: cz.pinterest.com

Source: cz.pinterest.com

Check the date in the top left corner of the form as it is updated occasionally by the IRS. Ad Access IRS Tax Forms. The W-9 form requires the contractor to list his or her name address and taxpayer ID number. Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Source: cz.pinterest.com

Source: cz.pinterest.com

Download Print Instantly. Filling out a W-9 for LLC is a critical part of filing your limited liability companys taxes correctly. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. It takes a couple of extra steps for you since Twitch is an American company. W9 is for business-to-business transactions where your organization may need to provide the vendor with a Form 1099 at the end of the year assuming total expenditures are greater than 600 for the year.

Source: cz.pinterest.com

Source: cz.pinterest.com

If you paid an independent contractor more than 600 in. Some restaurants may want an alternative form of verification that your organization is a qualified tax-exempt entity. A 1099 is an information filing form used to report non-salary income to the IRS for federal tax purposes. Employers create these forms for their employees and send copies to the SSA. It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification.

Source: cz.pinterest.com

Source: cz.pinterest.com

W9 is for business-to-business transactions where your organization may need to provide the vendor with a Form 1099 at the end of the year assuming total expenditures are greater than 600 for the year. W9 is for business-to-business transactions where your organization may need to provide the vendor with a Form 1099 at the end of the year assuming total expenditures are greater than 600 for the year. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. Lets go over what this means for you. All kinds of people can get a 1099 form for different reasons.

Source: cz.pinterest.com

Source: cz.pinterest.com

Form W-9 is used to provide a correct TIN to payers or brokers. The form helps businesses obtain important information from payees to prepare information returns for the IRS. It was developed by Internal Revenue Service with the purpose to control how self-employed individuals and businesses that provide services pay taxes they owe. A 1099 form is a record of income. There are 20 variants of 1099s but the most popular is the 1099-NEC.

The information part at the top. You need to fill out a W-4 anytime you start a new job. W-9 is a one-page form from the IRS. This form which is sometimes miswritten as a Form W9 first asks for information such as the person or entitys name and address. Boxes 7 through 10 on your W2 income form will include any special forms of income through that employer such as tips reimbursement.

Source: cz.pinterest.com

Source: cz.pinterest.com

Lets go over what this means for you. Some restaurants may want an alternative form of verification that your organization is a qualified tax-exempt entity. Form W-9 is used to provide a correct TIN to payers or brokers. This form helps you avoid an automatic 30 tax withholding on income earned from US companies. Employers create these forms for their employees and send copies to the SSA.

Source: cz.pinterest.com

Source: cz.pinterest.com

This form helps you avoid an automatic 30 tax withholding on income earned from US companies. Employers create these forms for their employees and send copies to the SSA. A 1099 form is a record of income. Form W9 provides you with the vendors tax ID number which you would need to send them the Form 1099. The title of Form W-9 is officially Request for Taxpayer Identification Number and Certification.

Form W9 provides you with the vendors tax ID number which you would need to send them the Form 1099. Complete Edit or Print Tax Forms Instantly. Ad Get Custom Templates Create Your W-9 In Minutes. Employers use this form to get the Taxpayer Identification Number TIN from contractors freelancers and vendors. This form is used to report mortgage interest income non-employee income and debt cancellation to the IRS.

Source: cz.pinterest.com

Source: cz.pinterest.com

To get started download the latest W-9 form from the IRS website. To get started download the latest W-9 form from the IRS website. Some restaurants may want an alternative form of verification that your organization is a qualified tax-exempt entity. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The part that you have to fill out looks like this.

Source: cz.pinterest.com

Source: cz.pinterest.com

It will ask for most of the same information youll need for the tax interview anyways. Taxpayers use the W-9 tax form to verify their. Print your full legal name as it appears on your income tax return here. Form W9 provides you with the vendors tax ID number which you would need to send them the Form 1099. Download Fillable W-9 Form.

Source: cz.pinterest.com

Source: cz.pinterest.com

Doing so correctly can prevent tax issues from. Download Print E-File Online. The IRS instructions are here for the W-8 and this is a handy guide for the form 8233. Taxpayers use the W-9 tax form to verify their. Complete Edit or Print Tax Forms Instantly.

Source: cz.pinterest.com

Source: cz.pinterest.com

Boxes 2 through 6 show you what income was withheld for taxes based on federal income tax state income tax Medicare social security tax and so on. To get started download the latest W-9 form from the IRS website. The form also provides other personally identifying information like your name and address. Keep in mind that youll need to. A 1099 is an information filing form used to report non-salary income to the IRS for federal tax purposes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does a w9 form look like by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.