Your What do underwriters look for loan approval images are available in this site. What do underwriters look for loan approval are a topic that is being searched for and liked by netizens today. You can Find and Download the What do underwriters look for loan approval files here. Download all royalty-free photos.

If you’re looking for what do underwriters look for loan approval images information related to the what do underwriters look for loan approval topic, you have visit the right site. Our site frequently provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

What Do Underwriters Look For Loan Approval. Ad Americas 1 Online Lender. Ad 2020s Online Mortgages. Look you said 65000 was enough cash reserves during the pre-approval of the mortgage and thats all I have. When underwriters look at your bank statements they want to see that you have enough money to cover your down.

What S Underwriting In The Mortgage Process Guild Mortgage From guildmortgage.com

What S Underwriting In The Mortgage Process Guild Mortgage From guildmortgage.com

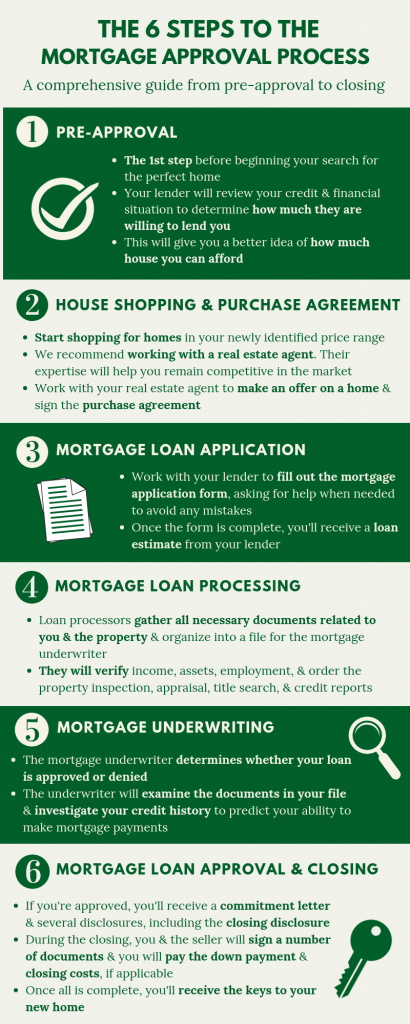

Conditional approval happens when all of your documents are turned in and. 485 35 votes. Compare Best Lenders Apply Easily Save. Ad Americas 1 Online Lender. A mortgage underwriter is the person that approves or denies your loan applicationLets discuss what underwriters look for in the loan approval process. Underwriting is the process of evaluating an application for a mortgage loan to determine if it meets specific guidelines set by the lender.

Comparisons Trusted by 45000000.

Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. We are three days away from closing. Best Pre Approval Mortgage Near Your Place. Ad 2020s Online Mortgages. As you undergo the underwriting process your loan will go through one or more of these steps. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Comparisons Trusted by 45000000. Youd better approve it or. How to Survive the Underwriting Process And Get the Loan You Need. An underwriter is a financial. The Underwriting Process.

Source: gustancho.com

Source: gustancho.com

Compare Rates Get Your Quote Online Now. Compare Best Lenders Apply Easily Save. When underwriters look at your bank statements they want to see that you have enough money to cover your down. Underwriting is the process your lender goes through to figure out your risk level as a borrower. We are three days away from closing.

Source: usbank.com

Source: usbank.com

The underwriter will determine if you qualify for the mortgage. Comparisons Trusted by 45000000. This article covers Multiple Mortgage Conditions By Underwriters On Conditional Approval Once the mortgage loan has been processed it will get submitted to the mortgage. Find out how mortgage underwriters reach their decision. However many people do not know.

Source: mojomortgages.com

Source: mojomortgages.com

Compare Rates Get Your Quote Online Now. Know that different lenders are looking for different criteria. Comparisons Trusted by 45000000. Compare Best Lenders Apply Easily Save. This article covers Multiple Mortgage Conditions By Underwriters On Conditional Approval Once the mortgage loan has been processed it will get submitted to the mortgage.

Source: inflooens.com

Source: inflooens.com

Also learn how they can all but assure your loan approval before you even go house hunting. Underwriting is the process of evaluating an application for a mortgage loan to determine if it meets specific guidelines set by the lender. Ad 2020s Online Mortgages. Compare Rates Get Your Quote Online Now. Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Ad Americas 1 Online Lender. What do underwriters look for on bank statements. Ad Americas 1 Online Lender. Underwriting is the process your lender goes through to figure out your risk level as a borrower. Underwriting is what dictates whether you will get approved for your mortgage.

Source: creditdonkey.com

Source: creditdonkey.com

Look you said 65000 was enough cash reserves during the pre-approval of the mortgage and thats all I have. Underwriting is the process of evaluating an application for a mortgage loan to determine if it meets specific guidelines set by the lender. However many people do not know. Conditional approval happens when all of your documents are turned in and. A mortgage underwriter is the person that approves or denies your loan applicationLets discuss what underwriters look for in the loan approval process.

Source: efinancemanagement.com

Source: efinancemanagement.com

Also learn how they can all but assure your loan approval before you even go house hunting. Compare Best Lenders Apply Easily Save. Find out how mortgage underwriters reach their decision. Conditional approval happens when all of your documents are turned in and. Compare Best Lenders Apply Easily Save.

Source: veteransunited.com

Source: veteransunited.com

Ad 2020s Online Mortgages. Underwriting is the process of evaluating an application for a mortgage loan to determine if it meets specific guidelines set by the lender. Youd better approve it or. Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan. A mortgage underwriter is the person that approves or denies your loan applicationLets discuss what underwriters look for in the loan approval process.

Source: houseopedia.com

Source: houseopedia.com

Ad 2020s Online Mortgages. Conditional approval happens when all of your documents are turned in and. If youre rejected for a business. The Underwriting Process. As you undergo the underwriting process your loan will go through one or more of these steps.

Source: qwikresume.com

Source: qwikresume.com

An underwriter is a financial. Underwriting is the process your lender goes through to figure out your risk level as a borrower. Find out how mortgage underwriters reach their decision. Ad Americas 1 Online Lender. The underwriter will determine if you qualify for the mortgage.

Source: richardsmortgagegroup.ca

Source: richardsmortgagegroup.ca

Compare Best Lenders Apply Easily Save. A mortgage underwriter is the person that approves or denies your loan applicationLets discuss what underwriters look for in the loan approval process. Compare Best Lenders Apply Easily Save. We are three days away from closing. Ad Americas 1 Online Lender.

Source: easymortgagecompany.com

Source: easymortgagecompany.com

During the underwriting process an underwriter will review your mortgage application and decide whether you are likely to be. Find out how mortgage underwriters reach their decision. An underwriter is a financial. Ad Americas 1 Online Lender. Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan.

Source: forbes.com

Source: forbes.com

Youd better approve it or. Look you said 65000 was enough cash reserves during the pre-approval of the mortgage and thats all I have. We are three days away from closing. Underwriting is what dictates whether you will get approved for your mortgage. Best Pre Approval Mortgage Near Your Place.

Source: guildmortgage.com

Source: guildmortgage.com

The Underwriting Process. Underwriting takes place after the loan officer. A mortgage underwriter is the person that approves or denies your loan applicationLets discuss what underwriters look for in the loan approval process. Also learn how they can all but assure your loan approval before you even go house hunting. Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan.

Source: homebuyinginstitute.com

Source: homebuyinginstitute.com

Best Pre Approval Mortgage Near Your Place. Ad Americas 1 Online Lender. It involves a review of every aspect of your financial situation and history. The mortgage process is dependent on underwriters. When underwriters look at your bank statements they want to see that you have enough money to cover your down.

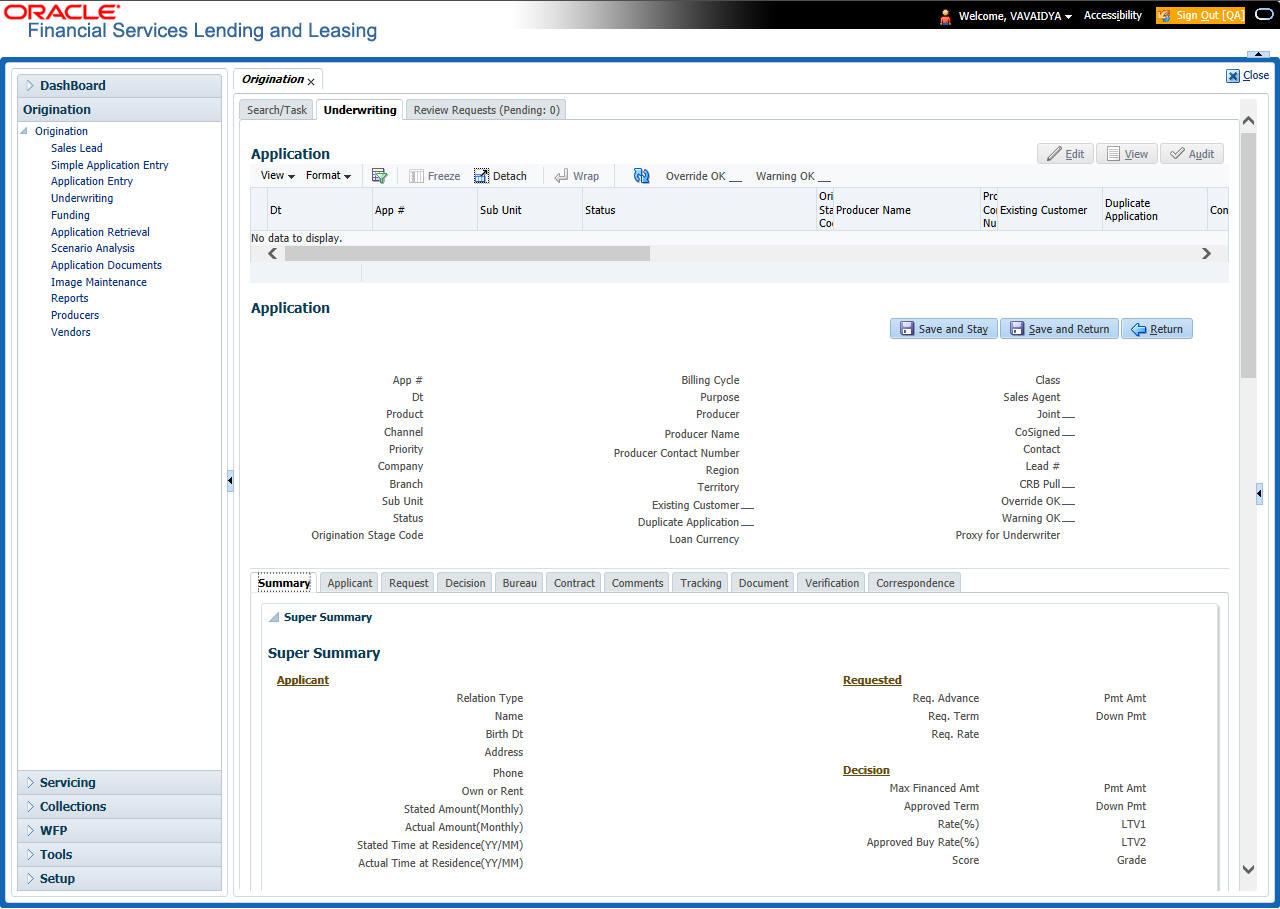

Source: docs.oracle.com

Source: docs.oracle.com

Conditional approval happens when all of your documents are turned in and. A mortgage underwriter is the person that approves or denies your loan applicationLets discuss what underwriters look for in the loan approval process. Ad Americas 1 Online Lender. Look you said 65000 was enough cash reserves during the pre-approval of the mortgage and thats all I have. Know that different lenders are looking for different criteria.

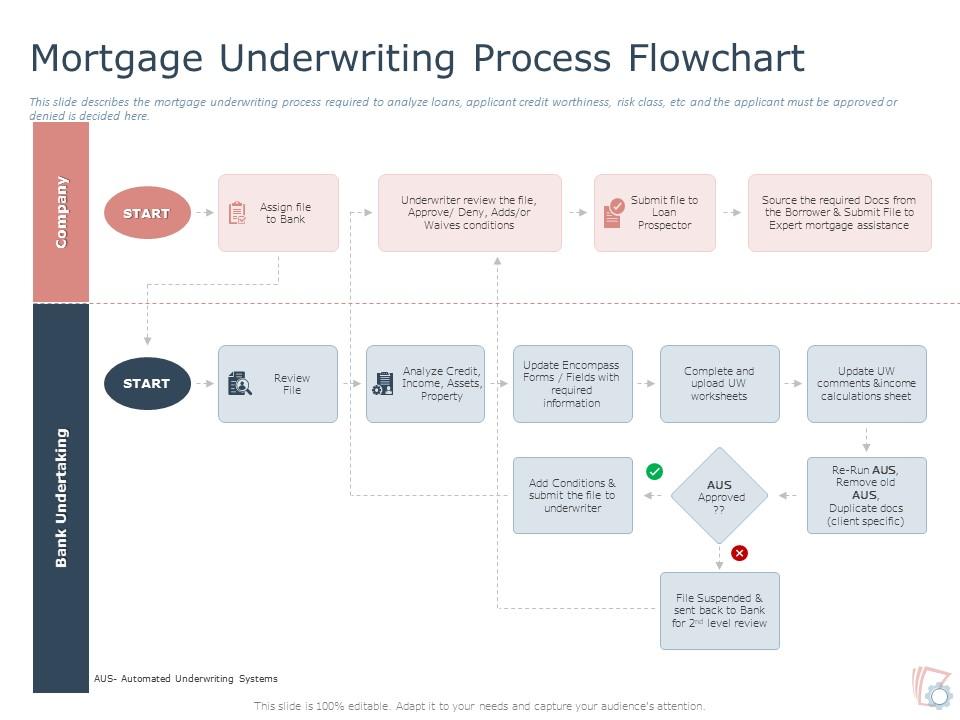

Source: slideteam.net

Source: slideteam.net

Comparisons Trusted by 45000000. The FHA lending process can be broken down into four primary parts application underwriting approval and closing. However many people do not know. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. Ad 2020s Online Mortgages.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what do underwriters look for loan approval by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.